MLP Compliance

Money Laundering Prevention

The phenomenon of money laundering is a major concern, both nationally and internationally. For preventing it, the effective implementation of systems and models of due diligence, control and supervision, in order to comply with current regulations is necessary.

To this end, we provide specialized and technical support, as well as offer training and customized awareness to the needs of each organization.

To this end, we provide specialized and technical support, as well as offer training and customized awareness to the needs of each organization.

Advice on Money Laundering Prevention (MLP)

Our firm has accredited and proven experience on the Money Laundering Prevention for advising customers and guarantee compliance with the obligations established by current regulations specialists. As well as to face the reputational risk that could arise from any form of involvement, even involuntary, in situations of this kind.

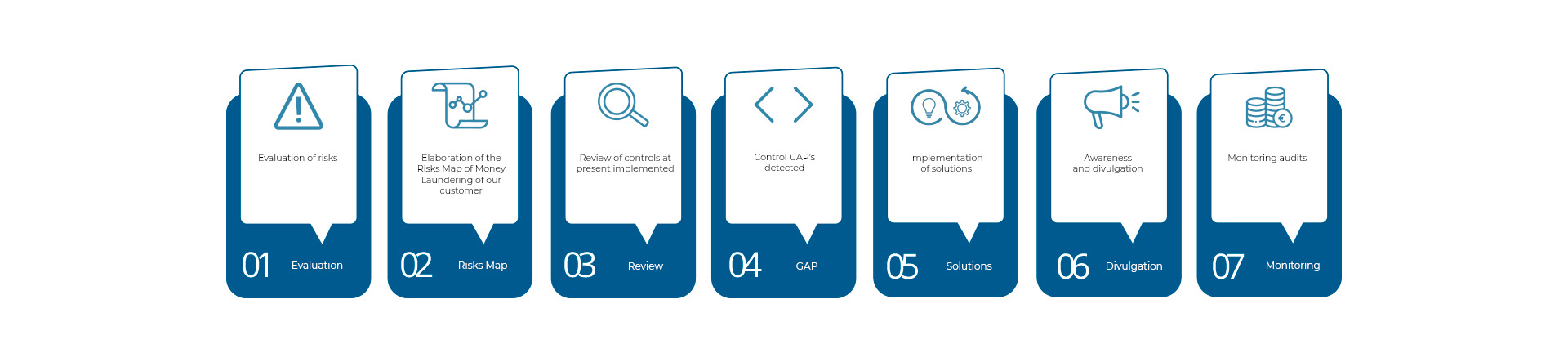

The Money Laundering Prevention Model developed by our firm includes the following phases:

The Money Laundering Prevention Model developed by our firm includes the following phases:

MLP’s Manual and definition of policies, standards and procedures

We bring our knowledge and support in the preparation and practical application of the Money Laundering Prevention Manual, as well as in the definition of policies, rules and procedures, to ensure the correct behaviour throughout the organization.

Further, our firm also offers advice on the establishment of internal control committee (composition, internal organization, etc.) necessary and adapted to the type of subject required.

Further, our firm also offers advice on the establishment of internal control committee (composition, internal organization, etc.) necessary and adapted to the type of subject required.

Analysis and documentation of suspicious transactions

As stated in the current law on Money Laundering Prevention (MLP), the main requirement referred to subject required (*) is the implementation of due diligence measures, including:

In addition, assuming that, as a result of our analysis, we known or suspected of being in operations related to money laundering is taken, it shall ensure a thorough examination and appropriate documentation.

Our specialists provide rigorous advice, in order to comply with these obligations for analysis and documentation, and to comply strictly with established rules.

(*) subject required: financial institutions, insurance companies, casinos, real estate, auditors, accountants, tax consultants, lawyers, attorneys, notaries, registrars, jewellers, art galleries and antiques, lotteries, custody, transportation of funds and foundations.

- Formal identification

- Identification of beneficial owner

- Inquiry of purpose in the business relationship

- Continuous monitoring (if repeated operations)

- Implementation of measures with risk approach

- Reinforced due diligence measures in the event of unusual, unique, offshore operations, etc.

In addition, assuming that, as a result of our analysis, we known or suspected of being in operations related to money laundering is taken, it shall ensure a thorough examination and appropriate documentation.

Our specialists provide rigorous advice, in order to comply with these obligations for analysis and documentation, and to comply strictly with established rules.

(*) subject required: financial institutions, insurance companies, casinos, real estate, auditors, accountants, tax consultants, lawyers, attorneys, notaries, registrars, jewellers, art galleries and antiques, lotteries, custody, transportation of funds and foundations.

Information and documentation to facilitate to the SEPBLAC

The Executive Service for the Money Laundering Prevention (SEPBLAC, according Spanish spelling) is the official state agency in charge to ensure compliance obligations in this area.

Additionally, in regard to customer due diligence, there are other requirements such as reporting obligations and prohibitions as:

To respect these obligations, our firm offers advice in order to provide all the information and necessary documentation to SEPBLAC corresponding to transactions with signs of being linked to money laundering.

Additionally, in regard to customer due diligence, there are other requirements such as reporting obligations and prohibitions as:

- Special review of operations

- Communication evidence by reporting models established by the supervisor

- Abstention trade execution

- Collaboration with SEPBLAC, to their requirements and instances

- Prohibition of disclosure and third suspects

- Document Retention: Minimum 10 years

To respect these obligations, our firm offers advice in order to provide all the information and necessary documentation to SEPBLAC corresponding to transactions with signs of being linked to money laundering.

Verification, monitoring and control

As external experts registered in the SEPBLAC, we are able to verify the correct implementation of the Money Laundering Prevention System established, assuming it exists. Otherwise, we propose to implement the most appropriate preventive system.

Our opinions and value judgments are always accompanied by recommendations and proposals for improvement, which we cooperate on its implementation and we monitor and control periodically.

Our opinions and value judgments are always accompanied by recommendations and proposals for improvement, which we cooperate on its implementation and we monitor and control periodically.

Training and awareness on MLP

To ensure the smooth functioning of the Money Laundering Prevention System, it is essential to have good planning plan specific training on this subject for managers/directors and the rest of the staff directly involved.

To this end, we offer information and training programs in both seminar and e-learning formats, so that the entire organization is aligned to the right direction.

To this end, we offer information and training programs in both seminar and e-learning formats, so that the entire organization is aligned to the right direction.

Definition of self-assessment model on Money Laundering Prevention System

Once the organization's compliance objectives have been determined and the criminal risks evaluated, the action plans are defined. These plans will be implemented according to the established order of priorities.

The implementation of the action plans will lead to the achievement of an adequate control environment. From its establishment it will be necessary to carry out a dynamic follow-up, through the availability of a Regulatory Compliance dashboard.

Logically, to ensure maximum visibility of the scorecard, it should be periodically reported to the highest administrative body of the company or institution, an essential circumstance to facilitate its permeability throughout the entire organization.

The implementation of the action plans will lead to the achievement of an adequate control environment. From its establishment it will be necessary to carry out a dynamic follow-up, through the availability of a Regulatory Compliance dashboard.

Logically, to ensure maximum visibility of the scorecard, it should be periodically reported to the highest administrative body of the company or institution, an essential circumstance to facilitate its permeability throughout the entire organization.

Assistance and dialogue with the SEPBLAC

Our firm provides assistance and support in order to interact with the SEPBLAC on behalf of our client, providing compliance reporting requirements, transmission of documents, data reporting, etc.

Legal representation in Courts

Our firm provides close support defending the interests of our customers in any lawsuit or legal claim.

.png)

.png)

.jpg)

.jpg)

![[...]](https://www.complia.es/xtra/imgs/loading.gif)